Introduction

The Explain Like I’m Five section outlines the bull and bear cases and potential risks. This introduction then here just to outline the below content and offer a high-level business model for SYG. If you are in a rush, read this. If you like graphs, read the below.

The asset management industry has particularly appealing economics. Firms carry high switching costs as people will not easily switch who they have given their life savings to. Most firms are capital light and scalable with most costs historically going towards employing high calibre managers. In recent times, firms have increasingly spent on tech-enablement – an important scaffolding for those managing large amounts of money passively.

Asset managers make their money from skimming profits off their Assets Under Management (AUM) annually. These can range from the standard 2% annual fee, 20% performance bonus fee of hedge funds, to the 0.1% fee of Satrix’ JSE Top 40 ETF.

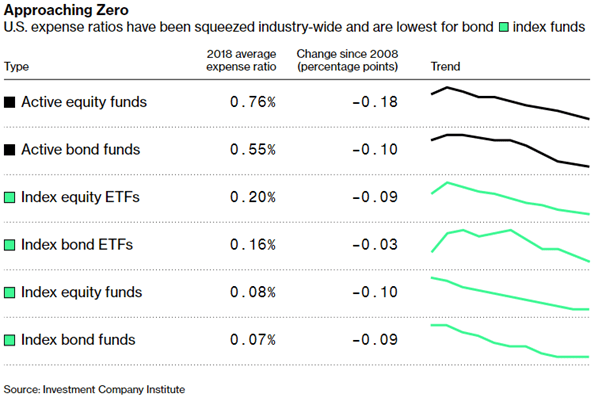

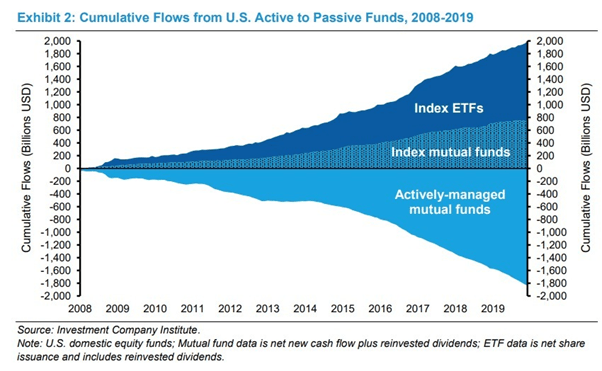

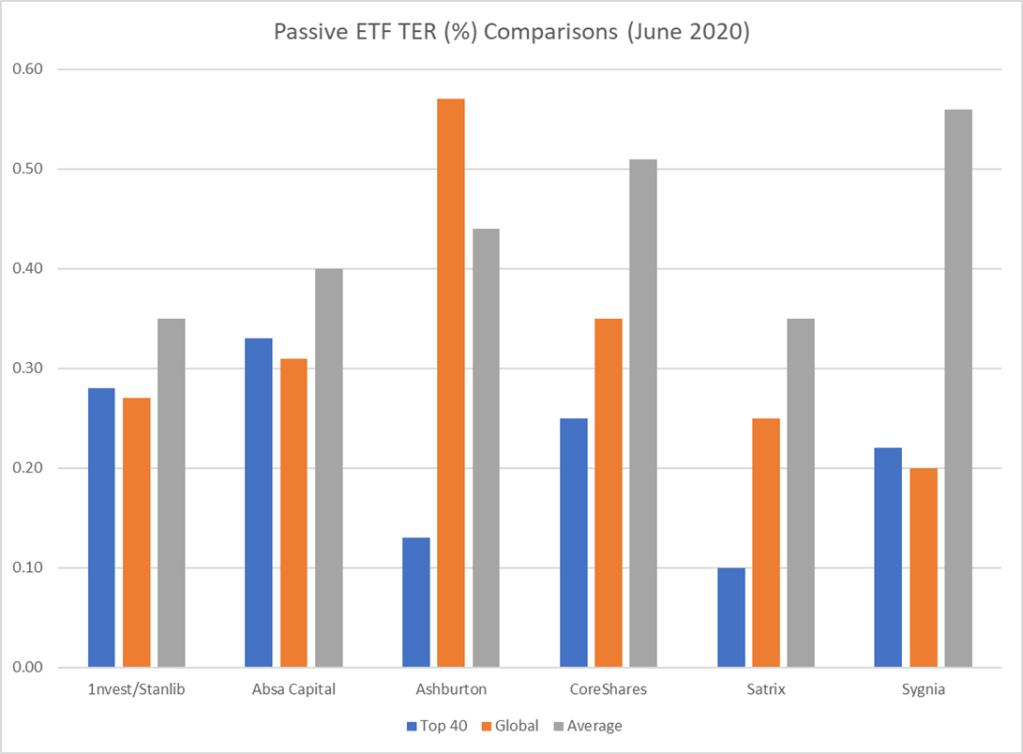

The industry is largely commoditized, with competitive pressure pushing Total Expense Ratios (TERs) on funds increasingly towards zero. Increasing consumer awareness, the inability of many fund managers to “beat the market” has contributed to this pressure and, in many markets worldwide, there has been a “race to the bottom” in fund fees (Figure 1).

South Africa has lagged the developed world in this aspect. There is a popular bent towards orthodox money managers, and the prevalence of ETFs and other passive vehicles has not yet made its way completely to our shores. Reasons for this include a lack of ETF marketing, less tax breaks than developed market investors, advisors not recommending ETFs, few multi-asset ETFs and historically inadequate fee-to-performance balances. Some of these reasons (such as the comparatively poorer performance) have been largely because of the struggling SA economy.

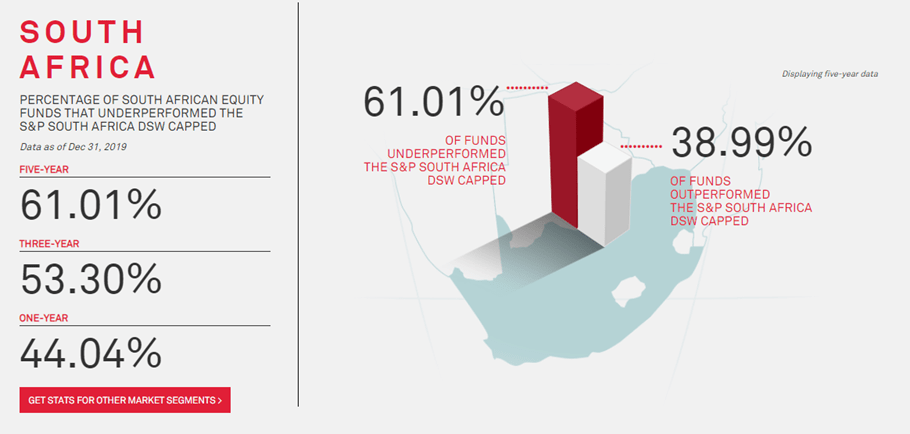

Yet, even in South Africa, most money managers have underperformed the benchmark index (S&P South Africa DSW Capped, Figure 2 below).

Over the past few years, Sygnia has slowly been addressing these barriers. They now have products that are significantly cheaper than the managed alternatives and passive peers, their products offer offshore diversification, and they have multi-asset ETFs which have outperformed most peers on a risk/reward basis.

The bull thesis, as mentioned above, rests on the fact that SYG can scale faster than competitors and will not suffer in the fee squeeze. As such, they stand to both gain market share and enjoy a growing inflow of assets as South African consumers follow the developed world into a more passive-centric investment standard.

SYG has shown strong growth in all relevant metrics since listing. The drivers of this growth are governed by the negative feedback loops of having to take market share from well branded competitors, and the positive feedback loops of providing customers better value for money through equal performance and cheaper fees than competitors.

They enjoy ample reinvestment opportunities as they continue to diversify their product range and enhance their multi-manager platform for institutional investors. Finally, being more scalable and having built their business model on low fees and tech-centricity, they are unlikely to struggle with adding value to customers as the pressure on management fees mounts.

Nevertheless, there are many questions and risks with this investment. Other than the high price tag, the primary risk is of governance and related parties. Owner-operator Magda Wierzycka has substantial sway with the board as she owns 60+% of the company. She presents a key-person risk and may jeopardize the interests of minority shareholders (conversely, such high ownership on her part may simply suggest she is very well aligned with shareholder incentives). In the past, minorities have been neglected in their protests against executive remuneration policies

The company has shown extravagance in their luxury offices and expensive art collection, all of which does not bode well for investor confidence. Wierzycka has also fired both KPMG and Deloitte on the grounds that they are involved in shady business. While admirable if well-intentioned, this understandably raises eyebrows for curious outsiders. Finally, Sygnia’s returns are highly dependent on economic growth, equity and fixed interest market returns, currency movements and investor sentiment.

All considered, SYG is a strong business with an enticing value proposition. There will likely be the COVID-related drop in earnings in the second half of this year, but over the next five years Sygnia is positioned to do very well should it execute on rapidly gaining market share.

Growth

Financials

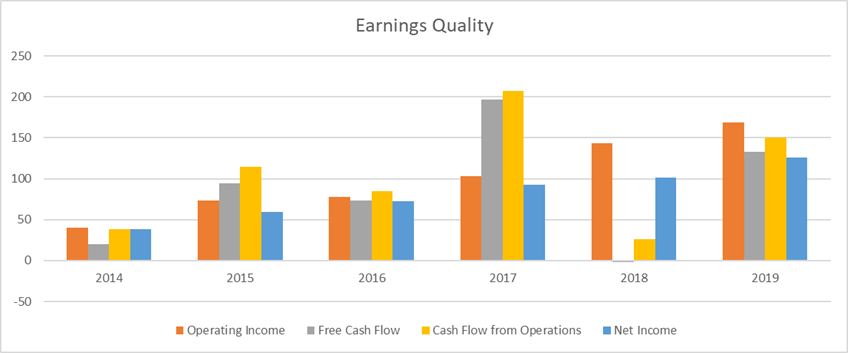

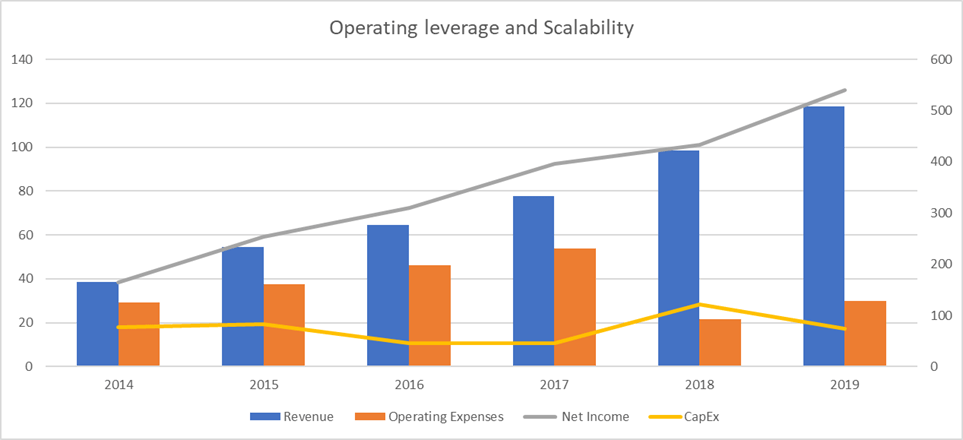

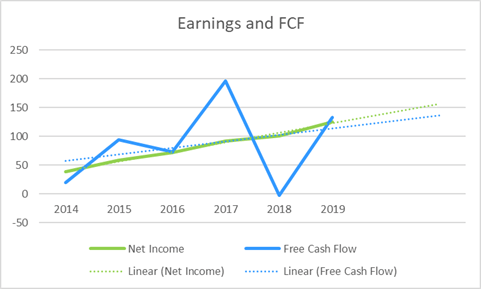

Sygnia’s growth has come steadily in some metrics, and erratically in others. The uneven free cash flow has come largely from rapid repayment of debt and changes in working capital even as earnings and revenue have risen steadily (Figure 3). Despite this, operating cash flow has remained firm relative to earnings, suggesting a solid foundation for earnings quality improvement (Figure 4).

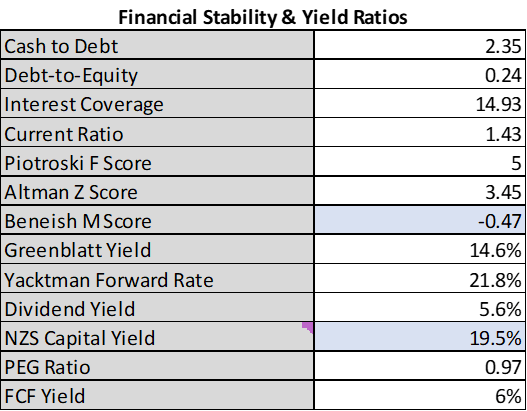

The company currently sits in a comfortable financial position and ticks the box on several typical metrics (Figure 5). By way of a brief unpacking, the yields mentioned below are various ways of evaluating prospective returns without looking to traditional DCF-based predictions or comparative valuations. The ratios mentioned are primarily around financial health and (as evidenced) SYG is not unduly indebted and has comfortable interest coverage. The scores (F, M and Z) are all used – typically in conjunction – to determine a company’s financial health and are discussed here. Suffice it to say that SYG is not in a worrying position.

One concern is the M score, which, if greater than -2.22, suggests the company is more likely to be manipulating earnings. Their current score is influenced majorly by the large increase in accounts receivable as a percentage of revenue year on year. While this typically suggests revenue inflation, it must be remembered that the M score is not infallible but is rather a heuristic to be read in accordance with other metrics. When looked at cohesively, SYG’s books and financial position are understandable and comfortably stable.

Interesting to note, the yield valuations are quite varied. Typically, an FCF yield of 10% is an acceptable valuation, so the 6% offered by SYG suggests mild overpricing. However, the Greenblatt and Yacktman Yields are comfortably high, and the NZS Capital Yield (FCF/EV + 5 Year FCF CAGR), which is a back-of-the-envelope heuristic to estimate forward returns, all suggest the company is currently trading at a fair value.

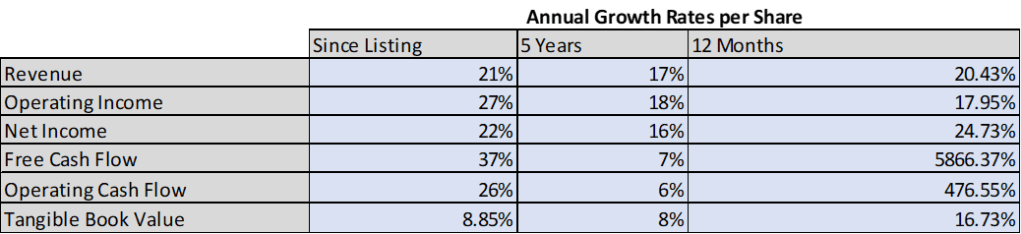

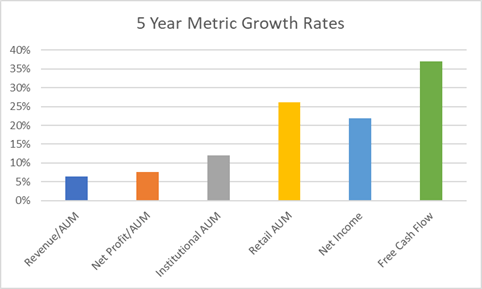

Figure 6 shows the growth rates to date. The primary question is how sustainable these growth rates are, and whether one can expect them to increase.

Duration and Drivers

“Companies that are disrupting large, established markets often do so with a value proposition that offers more opportunity for non-zero-sum value creation.

Often these companies are attacking an industry with large existing switching barriers, which allows the challenger to grow slowly (small position in a very large addressable market with the negative feedback loop of high switching costs) and invest for the long term with a disruptive model that creates more non-zero-sum value creation for the ecosystem constituents.”

SLINGERLAND ET AL. COMPLEXITY INVESTING.

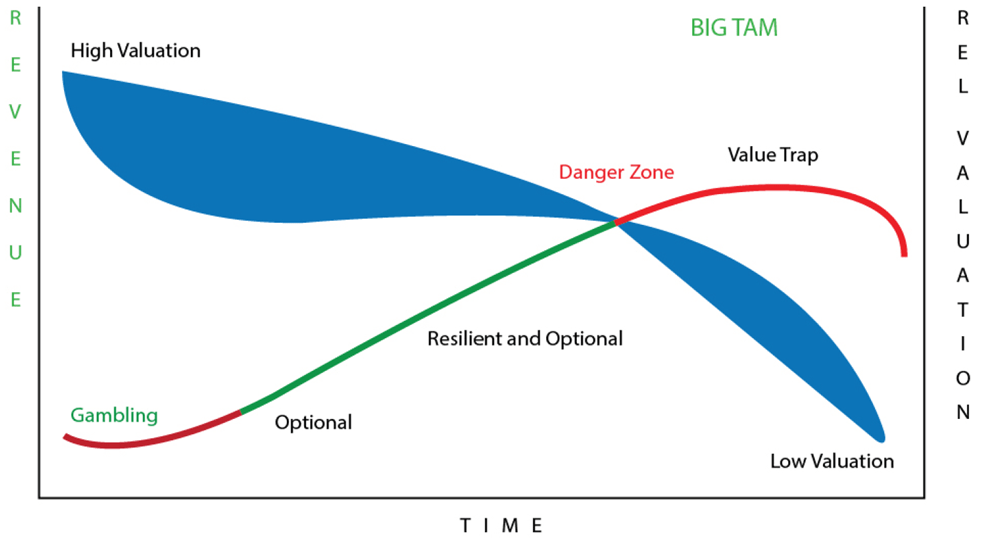

In thinking about a company’s returns over time, a long duration of steady growth is often more desirable than a parabolic burst. Companies like Proctor & Gamble have returned more to shareholders than companies like Groupon, which explode rapidly and dissipate in the same manner. One factor which enables a company’s steady growth over time is the existence of feedback loops in their industry. Another is having a large total addressable market (TAM). Asset management in South Africa satisfies both criteria: the TAM is estimated to be anywhere from R3-8 trillion, and the existing brands have significant switching costs, strong relationships with financial advisors and well trusted brands. For SYG to gain market share will be no easy task. However, it is these negative feedback loops that create the grit and healthy governance that allow a company a long compounding runway and extend a company’s S-Curve of growth (Figure 7).

In face of these challenges, there is also the necessity of positive feedback loops that self-reinforce a customer’s retention and encourage more customer acquisition. These are the “moats” of the business and they are often (but not always) tied to the unit economics the business faces. They will inform the company’s capital allocation decisions on reinvestment opportunities and strategic expansion.

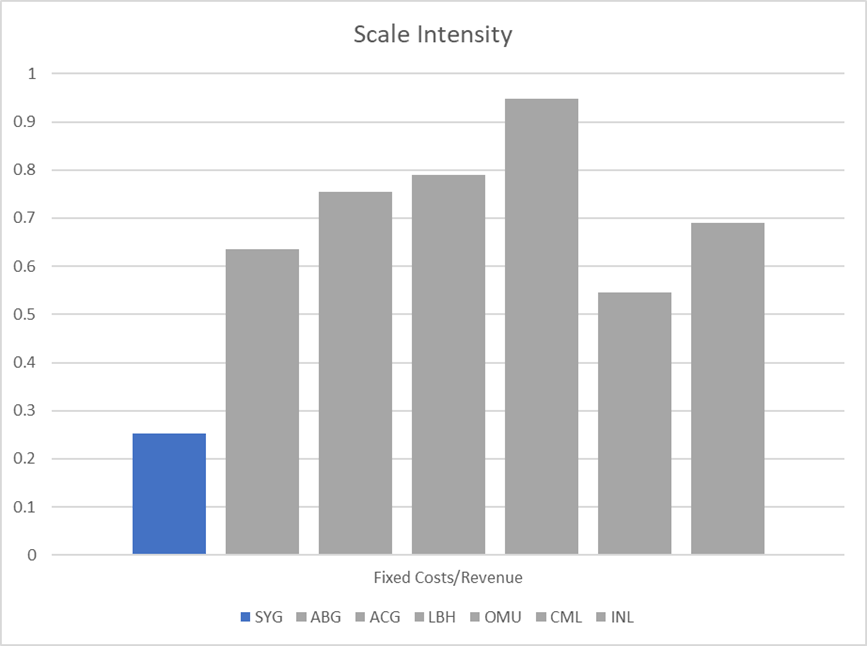

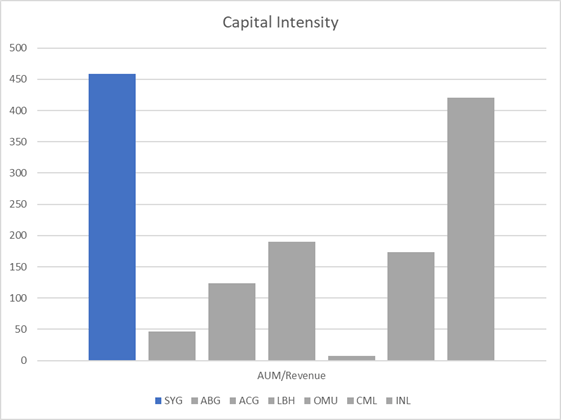

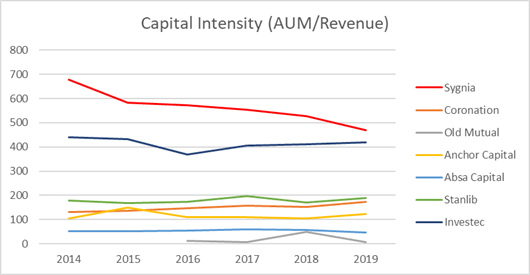

While Sygnia does not have such a succinct flywheel as a moat, the fact that they have built their business model to accommodate low fees means that as they scale their AUM, they will experience increasing growth rates on revenue and net profit. Their model is highly scalable due to its capital light nature (Figure 8) and its reliance on tech-enabled passive investment vehicles and administrative platforms rather than legacy systems and orthodox money management techniques. The company is also entirely vertically integrated, ensuring sustainability of this low-cost model.

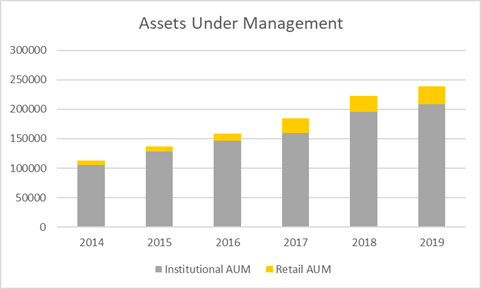

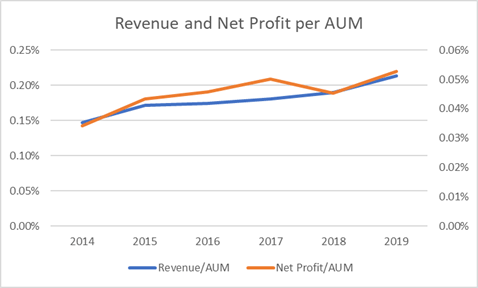

This effect can be seen in the sequence of graphs below. Figure 9 shows the increase in AUM since listing. Figures 10 and 11 show the increase in earnings and FCF since the same date and the historical growth in Revenue and Net profit per AUM. The growth rates of these metrics are shown in Figure 2.

The takeaway from these 4 figures is that as the company increases its AUM, it also increases the amount of money it earns from those AUM. To date, that may be simply because of the proportionally larger increase of Retail AUM, as retail products typically carry higher fees than institutional ones.

As we will see at a later stage in this article, SYG’s model – while carrying significantly lower margins on AUM than orthodox peers due to the lower fees charged – also enables it to scale better, and appears to have much more appeal for most customers.

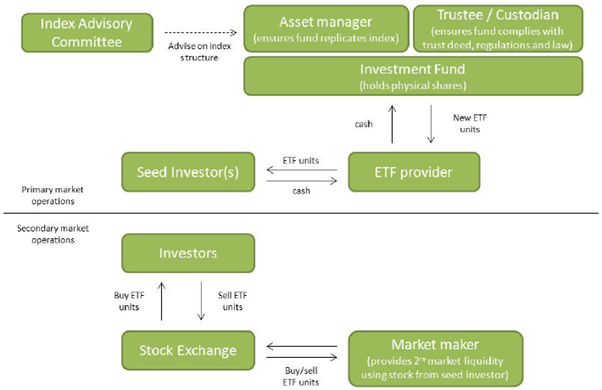

A second key offering of Sygnia’s has been its breadth of products. The construction of an ETF is a complex procedure requiring buy-in from a host of stakeholders, regulatory compliance, and substantial liquidity. Figure 13 below outlines the structure of an ETF.[1] In essence, this means that the first ETF to breach a market will be costly for the company to create, but once they have breached that broader market, they can offer auxiliary ETFs within that broader market at much lower costs. They are products which will benefit substantially from both scale and breadth. Here, SYG has a substantial first-mover advantage over local peers: they have been aggressively offering products a broad range of markets.

Their reinvestment opportunities encompass broadening their product offering, offshore expansion and investment into more tech-enhanced platforms like Roboadvisory. One particularly interesting acquisition for SYG would be to buy the holding company Purple Group (PPE). PPE offers a growing channel into the retail market and an opportunity for a bolt-on acquisition of an increasingly popular brand (EasyEquities) in the lower-end market.

The offshore expansion planned into the UK is concerning: In South Africa, SYG has the advantages mentioned above. In the UK, they are competing with far more established firms who can offer equally strong products at equally low costs. Internationally, SYG will struggle to compete with firms like Vanguard or Blackrock – giants of the passive investment sphere.

Another concern about SYG’s growth is its linkage to the broader South African economy. While market share can be gained and the pie slice increased, growth in the economy is a key driver for growth in Sygnia’s overall pie. As client institutions grow or contract so too will their investment assets (and SYG’s revenue base). Here, management should look to diversify into intra-African market. Doing so would lessen their dependence on the cyclical SA economy while widening their moat of first-mover advantage and gaining scale in new markets with much less competition.

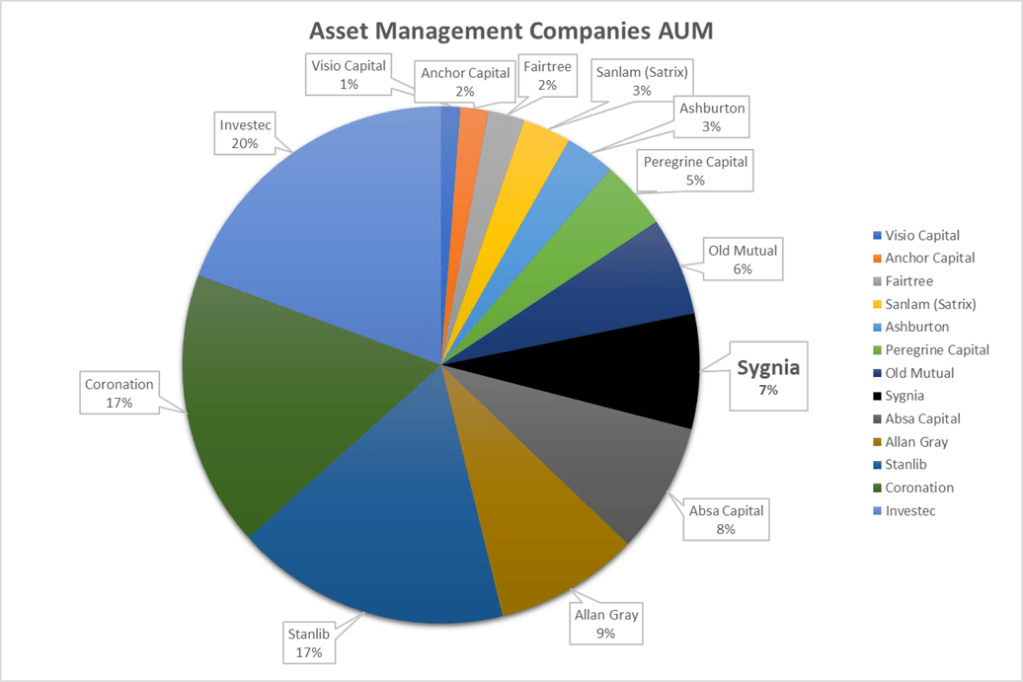

Scale continues to be a source of competitive advantage because if offers firms the opportunity for cost advantages on the back end, whilst allows them to make large investments in new capabilities. Currently SYG is not the leading scaled player (Figure 14 below).

Sygnia have made two key acquisitions in the past, both of which have proved successful and have positioned them well within the market. The first was the Gallet Group in 2016 which allowed the launching of SURF, Sygnia’s 50%-lower-costs-than-competitors umbrella fund. The second was db X-trackers from Deutsche Bank (later, Sygnia Itrix). This substantially increased SYG’s ETF offerings, bringing it a strong brand and established client base. Given the difficulty of creating ETFs in new markets, it is likely this acquisition which most enabled the bull thesis of this article.

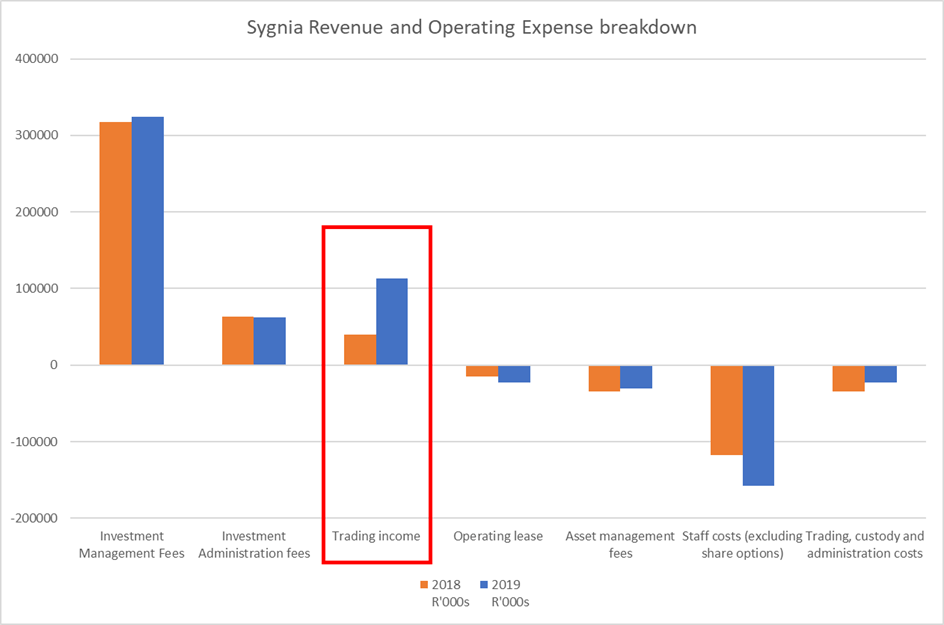

Approximately 40% of SYG’s revenue base (Figure 15) come from administration fees and trading income. In a zero-fee environment their investment management fees – which constitute the remainder of the revenue base – will decrease significantly. Given the pressure on passive management fees this is not an unforeseeable outcome, but it is unlikely to happen any time soon.

Notably, SYG’s trading income has increased by around 180% from FY18 to FY19 and is set to double again to FY20. The rising role this segment is playing in their revenue base makes them increasingly resilient to the zero-fee possibility.

All considered, SYG is still early on in its progression through its S-Curve (Figure 7) and is well positioned for future growth opportunities. Its resilient financial position, low leverage and strong historical growth all bode well for future expansion.

Context

Valuation

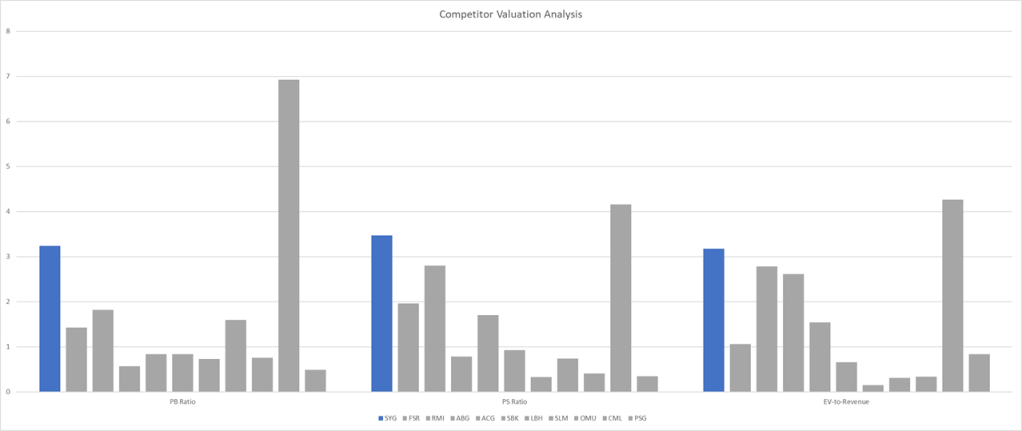

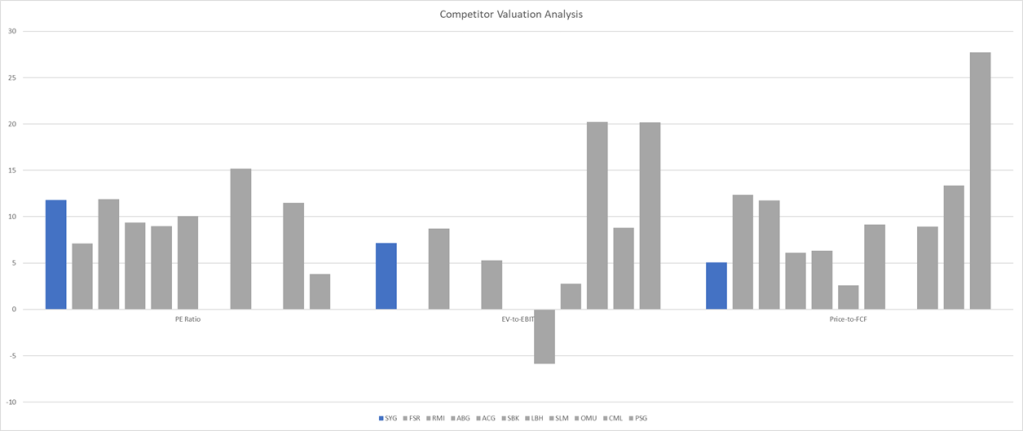

From a valuation perspective, the bull thesis falls a little flat. The company is priced expensively to competitors on almost all metrics, and has substantial growth baked into the current price from a discounted cash flow perspective. Figure 16 and 17 show SYG (blue) relative to local peers in the asset management industry on multiple metrics. The major takeaway is simply that it is pricey. Barring Price-to-FCF and EV-to-EBIT, Sygnia is priced second to only Coronation (CML). The FCF measurement is mildly deluding as SYG’s cash flow has been unusually high this year.

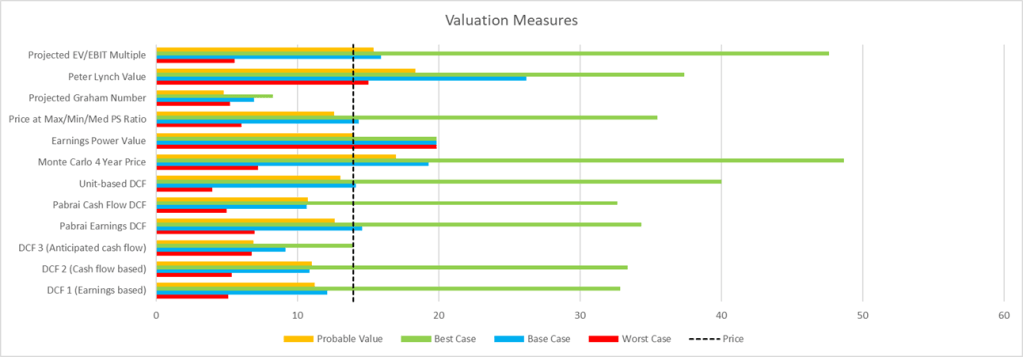

On an intrinsic valuation basis, the below Figure 18 shows where SYG sits across a broad range of valuation techniques. The purpose of these is to provide the viewer with a general impression of what kind of scenarios are currently priced into SYG’s retail value.

For many values, various DCFs have been used. The discount rate is a conservative 20%. The basis of the valuation are four scenarios: worst-case, base-case, best-case, and total-loss. These are attributed a 20%, 30%, 20% and 30% chance of occurrence, respectively. Further, the assumptions used in the cases are very conservative, with the best-case growth rates equal to or less than the CAGR since listing exhibited by the metric to date (Figure 6). Base-case growth is assumed roughly half of this and worst case is no growth.

The probability weighted fair value of SYG is R12.3/share, but this is a relatively unimportant number. The importance is seeing how much of a margin of safety is offered at current pricing. Per the figure above, the upside is still substantial, with valuations of over R40/share being warranted should the company grow as it has (or if the value proposition above plays out). However, the downside is still significant. In the recent COVID-19 selloff, the company was priced as low as R7.5/share. This could be considered a floor.

At current levels, the company offers large potential upside, but the bet is not a lopsided one.

Industry

The majority of the prevailing industry trends can be summed up in the buzzwords: automation, inclusion, impact, and product differentiation.

Under automation, from back office robotic-process automation to front end customer service and passive trading strategies, algorithms are moving from strength to strength (per this Deloitte article). As tasks are automated and software makes progressively more decisions, the industry is full of words like “data analytics” and “machine learning”. On the low and scaled end, this means continued increase in ETFs and passive funds. On the high end, quantitative and artificial intelligence strategies are becoming increasingly enticing for those who can afford them.

As discussed throughout this article, passive funds cost less to run and charge lower fees. They also outperform the majority of managed funds over long timeframes. Figure 19 below shows the outflow of funds since 2008 to from actively managed funds to passively run index-trackers.

The second primary industry trend is inclusion. Per these articles, legislature mandating financial inclusion via these passive strategies has been adopted in recent years.

Increasing access to information via widespread smartphone adoption alongside decreasing data costs has led to more people than ever becoming aware of their financial options. This decreasing information barrier has encouraged retail trading (seen in the rise of “Robinhooders”, and more locally EasyEquities investors). It has also brought awareness of passive strategies on an institutional and retail level (more here).

In South Africa, the low fees from passive strategies and automated front-end services like Roboadvisory are likely to appeal to both the poorer and the younger investors as Millennials and Generation Z’s begin to invest. This has been coupled by a recent increase in retail crowdfunding apps like Purple Group’s EasyProperties and Thomas Brennan’s Franc in an effort to “democratize finance”.

Environmental, Social and Governance (ESG) and “impact” based investing strategies have been recent beneficiaries of popularity too. Per this BCG article, this is partially because investors are recognizing the effect that ESG factors have on business success. It is partially too because the increase of data availability and related demands for transparency in how companies are tackling public awareness of social and environmental challenges.

Morningstar recently put out a report mentioning that both the number of sustainability-focused index funds, and their assets, have doubled over the past three years. In the U.S., which has lagged Europe in ESG investing, assets in sustainable index funds have quadrupled in the last three years and now represent 20% of the total.[2]

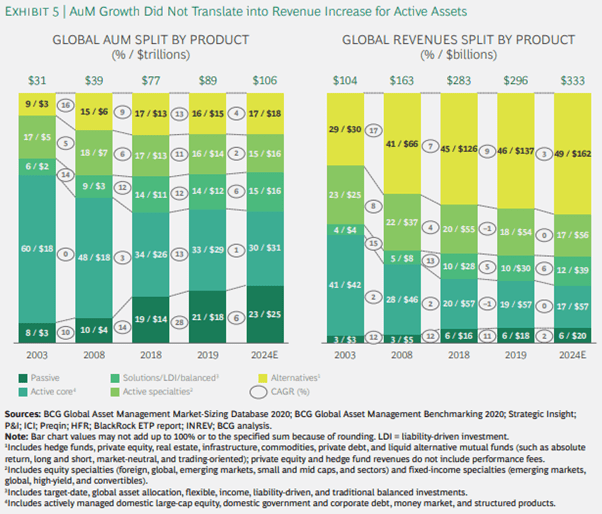

Asset management is a commoditized business. Increasingly firms require some form of product differentiation to draw funds. This could come by way of niche specialization, alternative offerings, and elite customer experience. As such, it is unlikely that traditional hedge funds will be able to keep their same high fee level.

In response to this trend towards decreasing fees, Bain & Co and BCG both suggest two strategies for asset managers: go big, or go niche. In other words, if a manager cannot scale effectively, they must either develop highly differentiated and niche offerings or risk redundancy. Sygnia is already offering niche products like their 4IR ETF, and – of all SA asset managers – they have the best chance at scaling.

Figure 20 below shows the increase in alternative offerings, both in revenue and product types. These will include inter alia specialty funds, PE/VC firms and real estate vehicles. This trend highlights the likelihood that scaled passive players (e.g. Vanguard) and niche active players (e.g. Universa) will continue to take market share from incumbents. Morgan Stanley’s Michael Mauboussin has recently written a convincing article outlining the long-term shift from Public to Private Equity evidenced by this trend.

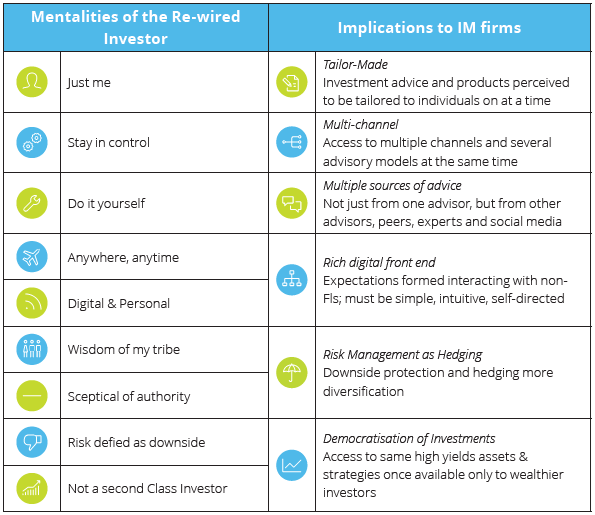

Finally, the onset of tech-centric millennial retail investors has altered the need for client-centricity from orthodox fund managers. According to Accenture and Deloitte, customer experience and digitized distribution have become increasingly important as investors move from reliance on traditional advisory services and obfuscating platforms towards a simpler DIY method. Figure 21 – taken from this Deloitte article below archetypes the millennial investor and their implications for firms.

At the risk of confirmation bias, these trends all serve to propel Sygnia’s investment paradigm (outlined in Figure 22 below, taken from their HY20 Financial Presentation).

Competitors

Note: Data for Satrix was unavailable from Sanlam. The data for remaining competitors was as best approximated from public online sources as possible.

Since the principal of the bull thesis rests on SYG outperforming its competitors, a good portion of the below is dedicated to explaining why. To materially outperform, SYG must both entice customers with better price and performance and must be able to extract sufficient more value from those customers than competitors would be able to.

SYG’s particularly scalable business model has already been unpacked above (Figure 8). Here, this model is compared to competitors and a brief product evaluation is given. Figure 23 is a comparison of the TER of several ETF offerings from SYG (far right) and several key competitors. SYG is materially lower than Stanlib, Absa Capital and Coreshares, but Ashburton and Satrix both offer cheaper locally focussed products than SYG.

However, many South African investors are looking to diversify offshore and into broader markets than just the JSE Top 40. Here SYG both offers the cheapest global opportunities, as well as the broadest exposure in offshore markets. All of these companies below (as passive management firms) are substantially cheaper than active managers like Allan Gray and Coronation.

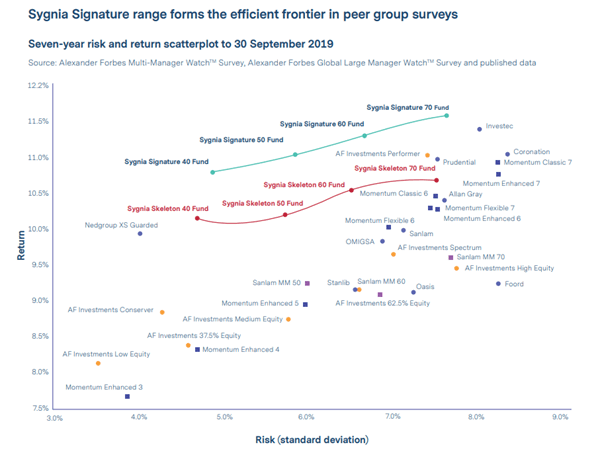

Sygnia has also managed to consistently perform in the highest tier of their peer bracket. Figure 24 below outlines the comparative performance of SYG’s flagship (and primarily institutional) funds: Skeleton and Signature. As evidenced, on a risk/reward basis they have performed very well. On a retail basis, their broad exposure to offshore markets paid off when four of their offshore-related ETF’s were in the top six funds for SA investors in a ten-year CAGR comparison (Figure 25).

Beyond the low-cost and comparable performance aspects, Sygnia also offers scalability that its competitors cannot compete with. Figure 26 shows the relative scale intensity of each company (measured as Fixed Costs/Revenue). Notice how SYG is distinctly better suited to scale than the others.

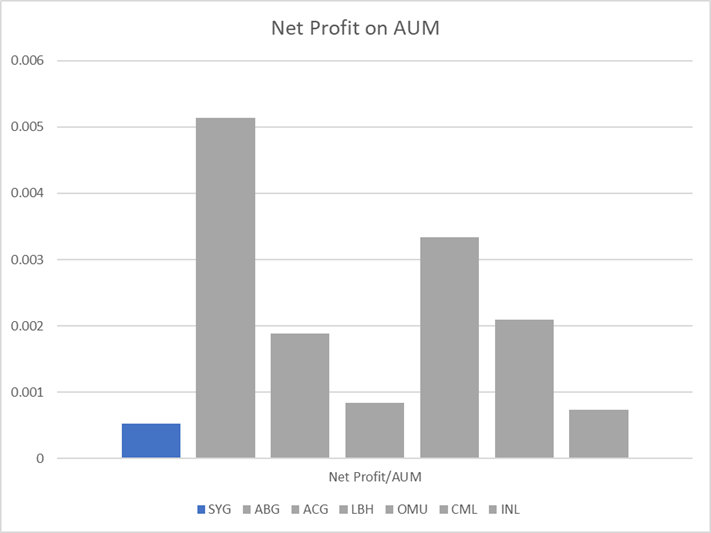

Figure 27 and 28 show the capital intensity and Net Profits drawn from AUM, respectively. Seen in conjunction, clearly Sygnia is built for a scale model. They require more AUM than competitors to draw an equivalent amount of revenue (a result of their low fees) and earn substantially less than competitors overall when factoring for AUM. While this may seem unappealing, it bodes well for the bull thesis. A company that is highly scalable and passes more value per Rand of AUM on to customers seems likely to benefit as more customers realize their benefit over time.

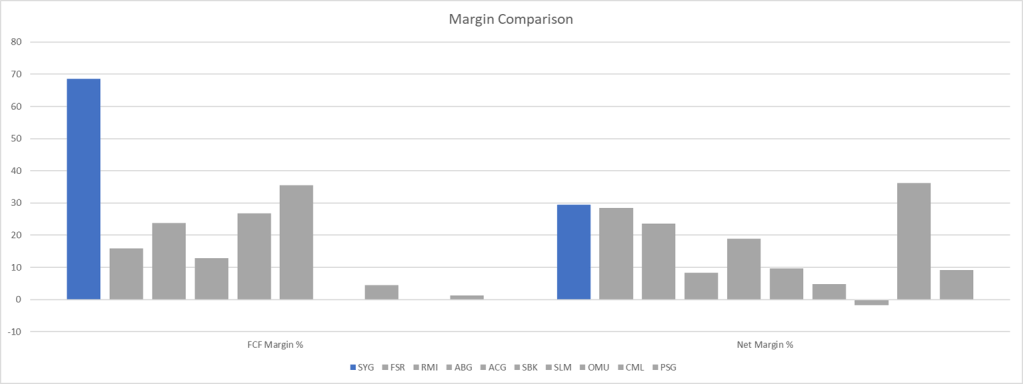

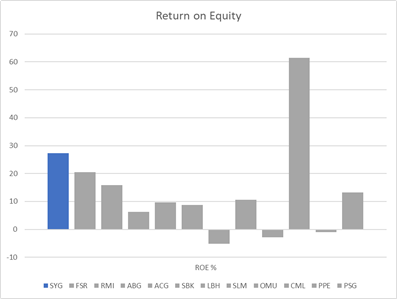

Where this model uniquely benefits shareholders is in the financial leanness of the organisation. Figure 29 shows the relative margins of Sygnia compared to peers. Their lack of legacy systems and their innovative approach to fund management enable them to generate more cash and drop more revenue through to the bottom line than competitors (Figure 29). They have also managed to earn a higher return on equity than most peers barring Coronation (Figure 30).

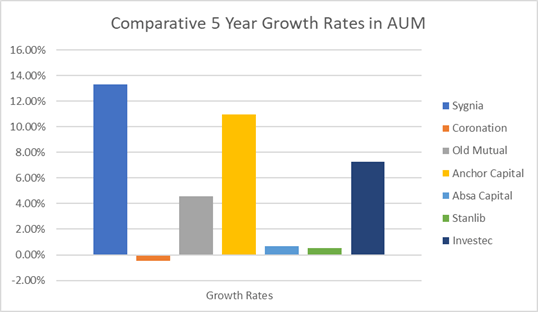

Finally, two interesting comparisons to make: firstly, SYG has decreased its capital intensity over time (Figure 31) while competitors have stayed majorly flat; and secondly, they have achieved far better growth in AUM over the last 5 years than competitors (Figure 32). The combination of these two comparisons suggests that SYG’s progressive gain in market share may be more imminent than it appears.

Probabilities and Assumptions

Speculation is a highly subjective activity. For clarity of thought, let us have a look at the rough predictions and assumptions upon which the bull thesis rests:

- Passive asset management continues to grow in popularity. A decently broad prediction which we can comfortably assign an 85% probability of occurrence at a 95% confidence interval.

- Sygnia will scale faster than competitors. Although the above data instils confidence this is still an uncomfortably narrow prediction. 70% probability with 90% confidence interval.

- Sygnia will not be hampered by poor international expansion, key person/governance risk or poor capital allocation on behalf of management. Another narrow prediction. 60% probability; 95% confidence interval.

- Sygnia will not be hampered by deteriorating economic climate in South Africa over the next 5 years. A broad prediction but the most uncertain. 51% probability; 90% confidence interval. The only recompense here is that their competitors will face the same economic front.

Given the substantial amount of speculation around the company, this is not entirely a no-brainer. The current price level (Figure 18) also adds little margin of safety into the bet.

Quality

Board and Management

It is hard to overstate the importance of strong management and good governance. If inadequate, they can kill an otherwise great company. However, metricising “good” in reference to management and governance is another subjective challenge for investors.

From an internal capital allocation front, management have increased their ROIC from 0.07% to 0.14% since listing. Further their Return on Tangible Equity has increased from 30.6% to 63.6%. These are tricky metrics to use for asset managers however, given their accountancy around AUM. It is the increase in these metrics then that is important and reflective of decent decision-making on behalf of management. Given management’s strong track record, it will be interesting to watch how the expansion into the UK plays out.

On the topic of capital allocation, management has opted to own a lavish art gallery in their offices (while curiously depreciating the art at a vague rate, despite art’s occasionally appreciative nature). Their Cape Town Waterfront offices are Rupert-Museum level extravagant, and have a swimming pool onsite. While appealing for employees, these raise questions towards the management’s thriftiness in spending shareholder funds.

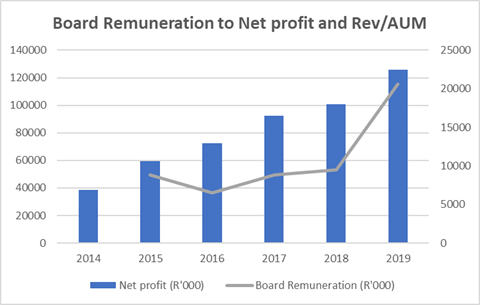

As far as shareholder centricity goes, management own ~67% of the company and the board remuneration has tracked to earnings without exceptional volatility (Figure 33). These are typically good signs. However, minority shareholders have been anecdotally maligned. So all this is to be taken with a pinch of salt.

The caveat to this is that founder-CEO Magda Wierzycka and her husband Simon Peile own about 63% of the company themselves. Further, in the company’s pre-listing statement, they outline related-party transactions with cash outflow to several entities (Widok & Beret Properties). Widok Properties is domiciled at Sygnia’s address and has Magda as a director, and Beret Properties is owned wholly by Magda’s family trust, Zatoka. There have also been more recent related-party transactions with Braavos Investment Advisers in the UK – another company owned in part by Magda.

This is not the first time these concerns have been raised, and Magda has faced her fair share of controversy. Her crusade against AYO has brought quite a bit of attention to her and her own activities, and she has faced confusion, criticism and congratulations since.

Her outspokenness against corruption stands in contrast to charges levelled against her, and it has been under her leadership that the company has come this far. Her activism and philanthropy have brought her favour in many circles, while her divisive commentary and controversy has – in other circles – dampened her previously warm receptions.

As the founder, leader, largest shareholder and a dominant personality, Magda has the entire company pretty much in her hands, and her leadership will impact its culture, shareholders, and future alike. In many cases (cf. Elon Musk, Jeff Bezos etc.), an iconoclastic and fanatical founder rewards shareholder very nicely. In other cases, however, the same founder may completely overpower the board’s oversight and cause irreparable harm to the business. Time will tell which founder Magda becomes.

To her credit, Magda’s salary has only risen by an average of 7% per year since listing and is still below the median CEO salary on the JSE.

The board composition is made up of mostly new members, with only the CEO, COO and Chairman being on the board for more than two years running. Typically, this bodes well for investors, as a “fresh” board will more easily take the outside view. Since 60% of the board is male and 70% White, Sygnia’s board is emblematic of many in South Africa. Having 8.5% Black ownership, the company is only Level 2 B-BBEEE certified. However, with 57% of the broader staff being women, many of whom are management, and 65% of the staff being black, the company is certainly better than most in enabling transformation. Interestingly, the company has also adopted a B-BBEE staff scheme whereby the Ulundi Staff Trust owns 6% of SYG. Black staff with one year of tenure are offered the opportunity to participate as beneficiaries.

Innovation and Culture

SYG market themselves as an agile “small corporate, with an arty, edgy feel”. They view themselves as tech-driven disruptors looking to do away with orthodox money management. The aesthetics of their office and its prime location, while not demonstrating the typical thriftiness investors prefer, does add to the appeal for employees. The culture appears to be akin to a high-end Silicon Valley start-up filled with well-paid individuals and designer coffee.

On the other hand, given Magda’s hefty personality and leadership, one will imagine her character has woven itself into the firm’s DNA as well. Her life story is a very interesting one: from living in Austrian refugee camps, immigrating with R500 in the bank and working in a supermarket to fund her high-school, suffice it to say she is no stranger to hardship, hard work and financial struggles.

The company has shown openness to rapid-fire deploy products to market. In the past, products have included a Bitcoin ETF, a 4th Industrial Revolution ETF and a Berkshire Hathaway ETF. Although the crypto ETF listing fell through, the diverse product range is indicative the company’s innovative efforts. The counter to this is that they may be critiqued for a scattershot approach and that these funds are often marketing plays which carry high fees. That said, one cannot deny they are unorthodox and innovative in a market full of orthodoxy and conservativism.[3]

Long-term thinking and an ability to adapt are crucial in a world governed by dynamic changes and uncertainty. As such, the company’s agility, disruptive positioning, and evolving product design are all arguably positive signs. The downside to such agility is that it suggests a lack of product “stickiness” and the pricing power that comes with a conventional moat. In this instance, given that the moat the bull thesis rests on (scale) has yet to realize in full effect, the downside is particularly risky. It is no use being agile if you cannot outperform your competitors, present and future. Nevertheless, the long-term thinking is there.

While there is little hard evidence of decentralized decision-making within management, absence of evidence is not evidence of absence. Magda appointed David Hufton as co-CEO – this is, at the very least, a nominal willingness to share decision-making. Their annual reports cite the retention of “a culture of entrepreneurial flair” as the reason for share-incentive schemes, and they market their culture as being “excellence-driven, with an open attitude and peer-review” and having a “high sense of individual significance”. On the flipside, founders often have a hard time relinquishing control and with 60+% ownership, there is little pressure on Magda to do so.

One final comment on the culture of the company: of all the asset management firms, it appears that Sygnia is the most customer centric. While others will market their performance, trustworthiness, and stability, SYG seems to be the frontrunner in passing cost-savings on to customers, creating ease of access to investments and having impressive customer experience. As always, anecdotal evidence can be found to the contrary, but it is the (unsubstantiated) opinion of this article that people posting reviews online are more prone to be the complaining type than the opposite.

Sustainability

The golden standard for business sustainability is the B Impact Assessment. It metricises the impact a company has in contributing towards the Sustainable Development Goals adopted by the UN in September 2015 and provides a way forward for the company in achieving these goals.

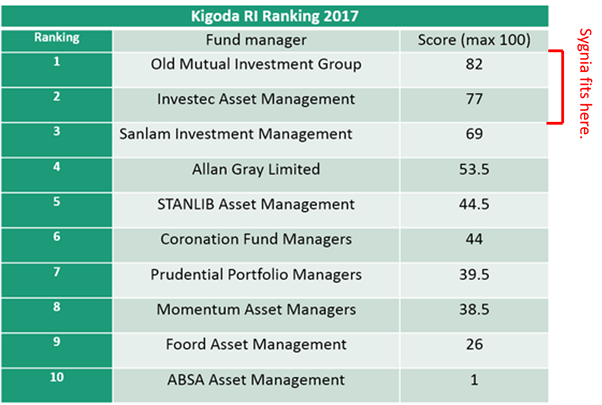

Such an assessment is beyond the scope of this article. However, lifting from their framework, and the work done by Kigoda on other SA asset managers, and combining with what is publicly available about Sygnia, one can construct a rough subjective scoring system across several metrics. As such, this article estimates Sygnia would score anywhere between 70-90 out of 100, placing them in the top 3 in their peer category.

Along with the push towards transformation in employee and board composition mentioned above, the company has taken several internal initiatives to “go green” and minimize excess energy consumption. They also contribute to the education of children through school creation and bursaries through their corporate social investment scheme.

Their customer centricity is industry leading and they have adopted the Treating Customers Fairly (TCF) framework. They push publicly for the transparency of costs in the investment industry, embrace boutique offerings via their Roboadvisory and similar services, publicise all information and attempt to (at least nominally) lower frictional costs should a customer wish to change away from their products.

“Invert. Always invert.”

You will notice, these are rough estimates and not necessarily direct inversions of the Probabilities and Assumptions above. Treat them as thought experiments.

Were we to recommend taking a short position, the following would have to happen:

- It would have to come to light that one of the executives have been syphoning substantial shareholder money from the company. A narrow prediction. 30% probability. 65% confidence interval.

- A large and botched expansion overseas subjects SYG to strong competition in an unfamiliar environment which accounts for a sizeable portion of its revenue. 51% probability. 70% confidence interval.

- A competitor is able to scale faster and offer better quality products for less than SYG. 35% probability. 85% confidence interval.

Asking what could kill the company, it is likely to be one of these three scenarios.

Conclusion

To summarize, SYG is an innovative business, led by a disruptive founder-CEO, with a large TAM and has the strongest potential to scale within the industry. Should they scale, they will increasingly become the de facto low-cost provider – able to pass on savings to consumers. In their current competitor set, this scale and the leanness of their business model will provide them with a sustainable competitive advantage.

They are best able to scale because their first-mover advantage is in a broader market range than competitors, their lean and tech-enabled model can handle price squeezes better than competitors, and because they are more customer-centric and have less legacy tech than competitors.

At large, the trend towards passive management in the industry has strong tailwinds. Further, the trends of automation, impact investing, and improving customer experience will all act in favour of SYG over peers.

Sygnia is, however, dependent on South Africa’s broader economy for growth in their overall pie. The tough challenges of COVID-19 will bring near-term headwinds, and their valuation does little to suggest a margin of safety. There is also the risk of Magda’s dominance over the board and company, which may prejudice minority shareholders. Her controversy raises questions around governance and key-person risk. However, the flipside of the Magda risk is that iconoclastic founders with borderline fanatical personalities have historically pioneered some of the world’s most impactful companies. She has demonstrated strong activism, conviction, and undeniable leadership qualities and may just become one of these industry-shifting figures.

Externally, Satrix and Stanlib are the biggest threats SYG currently faces. Satrix currently competes with Sygnia as low-cost providers for several products (but not all, nor overall) while Stanlib holds broader market share. There is also the threat of market entrants, but with their focus on tech and innovation, SYG is unlikely to be sideswiped by a novel fintech start-up.

All in all, it is the suggestion of this article that Sygnia be afforded a position on one’s watchlist for the reasons listed above. The recommended buy price is around R9.75/share. This would include a substantial margin of safety, cushioning the risks raised above. At current valuations, while still a comfortably strong investment prospect, there is little room for error.

[1] This source is a truly superb one in unpacking the construction method and critical success factors for ETF listings.

[2] Sygnia – as most companies – are aware of this trend. They have engaged with both FossilFreeSA in an open letter highlighting their development of ESG-based funds, and with Kigoda Consulting – an ESG-centric consultancy.

To the latter, they expressed frustration at the lack of social responsibility shown by South African asset managers. SYG has also recently launched their OSI Fund in the impact investing space.

[3] This Deloitte article suggests that “the key to effective innovation is not only to try invent new products, but rather to couple this with an attempt to pre-empt the next move of the market, the consumer or the regulator.” Good examples of this in recent years have been Satrix’ China ETF and Sygnia’s 4IR and OSI ETFs.